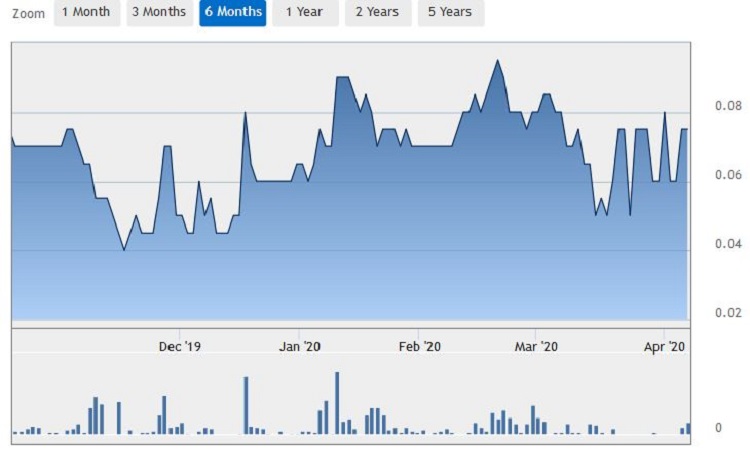

The share price of TFP Solutions Berhad has moved back to pre-MCO (Movement Control Order) levels when it settled at 7.5 sen today after touching a low of 5 sen during the period.

The reason why investors continue to be interested in the stock could stem from the TFP Group’s aspirations to make fintech (financial technology) its key engine of growth.

A recent media report stated that, once the MCO issued by the government is lifted, TFP intends to promote the OneCENT mobile financial technology (fintech) platform aggressively to the local market.

The OneCENT platform is believed to pave the way for TFP’s ecosystem of entrepreneurs to realise cashless digital lifestyles, while reaping rewards in the form of cash rebates and other incentives.

“We also have plans to pay commission for bill payments made via the OneCENT platform, as well as OTRemit (oversea remittance by foreign workers) referral fees,” TFP managing director Dato Hussian A.Rahman was quoted as saying.

Subscribers could also make cashless purchases at appointed merchants via the OneCENT digital wallet, he added, while there are also plans to introduce an optional prepaid VISA card for users to withdraw cash rebates from various local and overseas banks’ ATMs.

Dato Hussian explained that the OneCENT initiative complements the company’s existing OneCALL mobile fintech product.

TFP had introduced OneCALL last year when it inked a co-branding agreement with Tune Talk to target the “un-banked” population (people without bank accounts) throughout Malaysia.

“From our estimates, some two million Malaysians, representing eight percent of the country’s 24 million adults, do not have any bank account,” he said, before expressing his belief that there is an outflow of some RM20 billion worth or remittance via non-banking channels per year.

“Breaking the numbers down in further from the market size perspective, there are nine million people living in rural areas and 40 percent of Malaysia’s 32 million population falls within the B40 group,” he added.

TFP studies also indicate some two million Bangladeshis, a million Indonesians and 800,000 Nepalese currently residing throughout Malaysia.

“Hence, we had tailored OneCALL to address this market’s challenges including unique features such as remittance, virtual ATMs, game PINs, lifestyle tools, bill payments together with a B40 entrepreneur programme,” said Dato Hussian.

On the corporate front, TFP announced last month its plans to make a private placement of up to 62,020,100 new ordinary shares in TFP, representing approximately thirty percent of the existing total number of issued shares in TFP (excluding 1,279,000 treasury shares).

The exercise is tied in with an issuance of up to 134,377,022 free warrants on the basis of one warrant for every two TFP Shares held on an entitlement date to be determined later.

The bulk of the proceeds raised would be utilised to realise the company’s mobile fintech business plans.

“The past one year has been a purposeful one for the TFP Group as we turned the corner to emerge as an end-to-end fintech entity,” said Dato Hussian.